A long-standing issue concerning homeowners’ insurance rates in North Carolina has finally been resolved. After more than a year of negotiations and discussions, a settlement has been reached between the Department of Insurance and the North Carolina Rate Bureau, which represents the state’s homeowners’ insurance companies.

The new agreement provides much-needed relief to homeowners, preventing the steep rate hikes that many feared. Here’s a breakdown of the settlement and what it means for North Carolina consumers.

The Deal: What Does it Mean for Homeowners?

On June 1, 2025, homeowners in North Carolina will see an average base rate increase of 7.5%, followed by another 7.5% increase on June 1, 2026. This settlement limits the rate hikes to a maximum of two increases, both spaced out over the next two years. Additionally, the insurance companies will not be able to raise rates again before June 1, 2027.

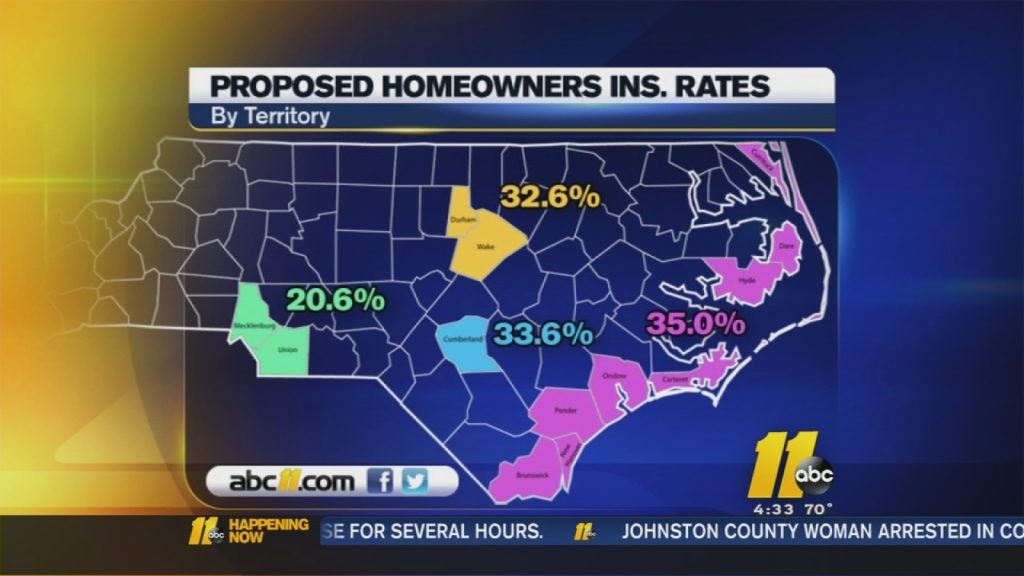

While homeowners’ insurance companies originally proposed rate hikes as high as 99.4% in some areas, and an average 42.2% increase across the state, the settlement effectively reduces these numbers. The agreed-upon increase of 7.5% in each of the two years is far less than what was initially suggested, with a maximum rate increase of 35% in any specific region.

A Victory for Consumers: How it All Came Together

In February 2024, after receiving over 24,000 comments from concerned policyholders, the proposed rate hikes were flatly rejected by me. It was clear that consumers were unhappy, and rightfully so. The Rate Bureau’s request seemed excessive, and I could not allow such an impact on homeowners’ budgets.

By law, when I deny a rate request, a public hearing must be scheduled. In this case, a hearing was held, starting on October 7, 2024, to address the dispute. As the hearings progressed into the new year, the Rate Bureau approached me with the possibility of reaching a settlement, and fortunately, we were able to work out a deal that benefitted consumers.

This settlement is not only a win for homeowners but also a testament to the importance of having strong consumer protection measures in place. The Department of Insurance worked tirelessly to ensure that the financial burden on homeowners was kept to a minimum while still maintaining the necessary stability for the insurance companies.

A Huge Financial Impact: $777 Million Saved

One of the key highlights of this agreement is the substantial amount of money that homeowners will save in insurance premiums over the next two years. Compared to what the insurance companies had initially requested, the settlement will save consumers approximately $777 million in premiums.

This is a direct result of the efforts made by the Department of Insurance to ensure that the rate hikes were reasonable and justified. The goal was never to stifle the insurance companies but to ensure that they were financially sound while not overburdening consumers.

Why This Matters: Protecting North Carolina’s Insurance Market

Insurance regulation in North Carolina is a delicate balancing act. On one hand, rates must be high enough to ensure that insurance companies have the necessary funds to cover the claims they pay out. On the other hand, rates must remain affordable for consumers, especially in a state where homeowners rely on affordable insurance to protect their homes.

North Carolina is fortunate in that its insurance market remains healthy and competitive compared to other states. While some areas of the country are facing challenges with insurance availability and affordability, North Carolina has managed to maintain a stable market, offering homeowners more choices than they might have in other states.

This is a direct result of the regulatory measures that have been put in place to protect consumers and maintain a competitive market. While rate increases are sometimes necessary, it is crucial that they are done in a way that does not unduly harm consumers. This settlement is a perfect example of how regulation can work in favor of the people.

What’s Next? Looking Ahead

While this settlement is a major victory for North Carolina homeowners, it is important to remember that the work does not stop here. As your Commissioner, I will continue to fight for the best interests of consumers and ensure that the state’s insurance market remains healthy and competitive.

Since I took office in 2017, I have made it a priority to reject any proposed rate increases that I believe would harm homeowners. This settlement is just the latest in a long line of efforts to keep North Carolina’s rates among the most affordable in the nation.

Looking ahead, the Department of Insurance will continue to monitor the state’s insurance market and work with both consumers and insurance companies to ensure that North Carolina remains a place where homeowners can afford the coverage they need to protect their homes.

How You Can Get Help

If you have questions about your homeowners’ insurance or need help with a claim, the Department of Insurance is here to assist you. You can reach out to us by visiting our website at www.ncdoi.gov, calling 855-408-1212, or emailing me directly at Mike.Causey@ncdoi.gov.

We understand that insurance matters can be confusing, and we are committed to making sure that homeowners have the information and support they need to navigate the system. Whether you need help understanding your policy or need guidance through the claims process, we are here for you.

The Bottom Line

This settlement is a win for North Carolina homeowners, saving them millions of dollars and providing stability in the insurance market. While the process was lengthy, the results speak for themselves. Consumers will see lower rate hikes than originally proposed, and the insurance market will remain strong and competitive. The Department of Insurance will continue to work hard to ensure that homeowners are protected and that North Carolina remains one of the best states in the nation for affordable insurance.

Disclaimer – Our editorial team has thoroughly fact-checked this article to ensure its accuracy and eliminate any potential misinformation. We are dedicated to upholding the highest standards of integrity in our content.

More Stories

North Carolina Homeowners Win Big as Insurance Rate Settlement Saves Consumers Millions

North Carolina Homeowners Win Big as Insurance Rate Settlement Saves Consumers Millions

North Carolina Homeowners Win Big as Insurance Rate Settlement Saves Consumers Millions