Undocumented immigrants play an unexpected but vital role in financing programs like Social Security. Despite being unable to collect benefits, this group contributes billions of dollars annually to the system. Their contributions, though often overlooked, have become essential to the financial health of the program.

In 2022, undocumented workers paid an estimated $25.7 billion in Social Security taxes, according to the Institute on Taxation and Economic Policy. These funds effectively act as a subsidy for millions of Americans who rely on Social Security for retirement and disability benefits.

Yet, these workers face a harsh reality: without changes to their immigration status, they cannot access the benefits they help fund. This paradox highlights the complexity of the immigration debate and its significant implications for the U.S. economy and Social Security system.

A Crucial Contribution to Social Security

Social Security faces ongoing financial challenges. Demographic shifts, including falling birthrates and an aging population, have left fewer workers to support the growing number of retirees. According to Shai Akabas of the Bipartisan Policy Center, net immigration is one of the few factors positively counteracting this trend.

“Immigrants, including undocumented workers, are often younger and at the start of their careers,” Akabas explains. “They contribute to Social Security for years before they may ever claim benefits—if they can claim them at all.”

The Social Security trust fund is projected to run out by 2033, leaving tax revenues sufficient to pay only 79% of scheduled benefits. Without reform, beneficiaries could face a 21% reduction in payments. Immigration policy, including the presence of undocumented workers, could influence the system’s future.

How Undocumented Workers Pay Taxes

Many undocumented workers pay taxes despite lacking legal status. Employers typically require a Social Security number to hire workers, leading some undocumented individuals to use fabricated or borrowed numbers. These contributions go into the Social Security system but remain unmatched to a valid account, creating a surplus.

Additionally, the Internal Revenue Service (IRS) issues Individual Taxpayer Identification Numbers (ITINs) to allow individuals ineligible for Social Security numbers to file taxes. These numbers ensure compliance with tax laws, even for undocumented workers.

While some fear that filing taxes could expose them to deportation, protections prevent the IRS from sharing taxpayer information with other federal agencies. For many, filing taxes is a way to demonstrate good moral character, which could support future immigration cases.

The Ripple Effects of Immigration Policy

Immigration policies significantly influence Social Security’s financial health. A report by the Social Security Administration highlights how varying levels of net immigration impact the program’s solvency:

- If annual net immigration decreases to 829,000, the system’s long-term financing shortfall worsens by 10%.

- Conversely, if immigration increases to 1.7 million annually, the shortfall improves by 10%.

Each additional 100,000 net immigrants reduces the funding gap by 0.09% of taxable payroll. This demonstrates how immigration can directly support the program’s stability.

The Broader Economic Impact

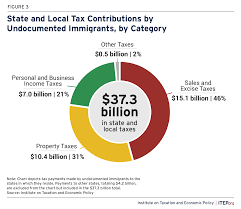

Undocumented workers’ contributions extend beyond Social Security. In 2022, they paid $96.7 billion in federal, state, and local taxes, with one-third going toward payroll taxes. These funds also support Medicare, unemployment benefits, and other public programs.

Carl Davis, research director at the Institute on Taxation and Economic Policy, notes, “It is well established that undocumented workers contribute to the solvency of major social insurance programs through their tax payments.”

If mass deportation policies were implemented, as proposed in the past, Social Security could lose approximately $20 billion annually in cash flow. This would exacerbate existing financial challenges and potentially lead to broader economic consequences.

The Human Side of Tax Contributions

For undocumented workers, paying taxes is often a matter of principle and hope. Many view it as a step toward integrating into American society and demonstrating their commitment to the country.

“They want to be part of the system,” says Sarah Lora, director of a low-income taxpayer clinic at Lewis & Clark Law School. “For many, there is almost a reverence for the tax system. Filing taxes is a way to show they are contributing and doing the right thing.”

These workers may never see the benefits of their contributions, but their efforts sustain programs relied upon by millions of Americans.

The Road Ahead for Social Security and Immigration

The future of Social Security depends on addressing its financial challenges, which are closely tied to immigration policy. With U.S. fertility rates declining, net immigration is projected to account for all population growth by 2040.

Experts argue that thoughtful immigration reform is essential to maintaining Social Security’s solvency. “If the immigrant workforce declines, the program’s financial picture will worsen,” says Akabas. “Reforms in other areas would then need to be more significant.”

While the broader immigration debate involves complex issues beyond Social Security, the contributions of undocumented workers highlight their integral role in the U.S. economy.

Conclusion: Recognizing an Overlooked Contribution

Undocumented immigrants provide crucial support to Social Security and other public programs through their tax contributions. Their role underscores the interconnectedness of immigration policy, economic stability, and social welfare programs.

As policymakers debate the future of Social Security, acknowledging the contributions of all workers, regardless of status, is essential. By addressing misconceptions and considering the economic realities, the U.S. can move toward solutions that benefit everyone.

Disclaimer – Our editorial team has thoroughly fact-checked this article to ensure its accuracy and eliminate any potential misinformation. We are dedicated to upholding the highest standards of integrity in our content.

More Stories

The Untold Story of How Immigration Supports Social Security Stability

The Untold Story of How Immigration Supports Social Security Stability

The Untold Story of How Immigration Supports Social Security Stability