Social Security payments have long been a vital source of income for retirees, disabled individuals, and many Americans relying on this financial support. However, in 2025, many beneficiaries might notice their Social Security checks decreasing, even though it may not be widely discussed. Understanding why these payments are quietly dropping is essential for anyone depending on this income.

In this article, we explore six key reasons behind this change. These factors include government policies, economic shifts, and changes in inflation calculations. If you’re concerned about your or a loved one’s payments, keep reading to learn more about these important developments.

1. The Cost-of-Living Adjustment (COLA) Is Smaller Than Expected

Social Security payments usually increase each year to help beneficiaries keep up with inflation. This increase is called the Cost-of-Living Adjustment or COLA. However, in 2025, the COLA is expected to be smaller than in previous years because inflation rates have slowed down. According to the Social Security Administration (SSA), this smaller COLA means payments won’t rise as much, effectively reducing the real income for many recipients.

2. Inflation Measurement Changes Affect Payment Calculations

The way inflation is calculated affects the size of Social Security increases. The government recently made changes to how the Consumer Price Index (CPI) is measured, which impacts the COLA. These new methods tend to show lower inflation rates, reducing the annual increases for payments. The Bureau of Labor Statistics explains that this can lead to smaller benefit raises, thus lowering overall Social Security payments despite rising living costs for some.

3. Payroll Taxes and Income Limits Are Not Increasing Enough

Social Security benefits are funded by payroll taxes collected from workers and employers. In 2025, changes to payroll tax rates and the income cap on these taxes remain limited. This means less money is coming into the Social Security fund, which can impact the amount available for payments. The Tax Policy Center notes that without sufficient funding, benefit growth may slow down or even drop in some cases.

4. More Recipients Are Entering Retirement, Increasing Demand

The baby boomer generation continues to retire, increasing the number of Social Security beneficiaries. As more people begin to receive payments, the Social Security trust fund faces higher demands. This increased pressure can slow the growth of payments, leading to smaller checks for individuals as funds are stretched thinner.

5. Changes in the Social Security Trust Fund Health

The Social Security trust fund is the reserve that supports payments when taxes collected are not enough. In recent years, the trust fund’s balance has been decreasing steadily. Experts warn that if this trend continues, the government may have less money to pay out full benefits, leading to reduced payments in the future. This financial strain translates into quieter cuts in benefit amounts over time.

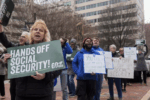

6. Policy Decisions and Legislative Changes

Finally, lawmakers play a big role in determining Social Security payments. Recent policy discussions focus on ways to make the system more sustainable, including adjustments to benefit formulas and eligibility rules. Some of these changes, implemented or proposed, may result in smaller payments for certain groups, especially higher-income beneficiaries. Staying updated on new legislation is important for anyone depending on Social Security.

Understanding these factors helps explain why Social Security payments might quietly drop in 2025. Keeping an eye on official announcements from the Social Security Administration and related government agencies will help you stay informed and prepared for any changes.