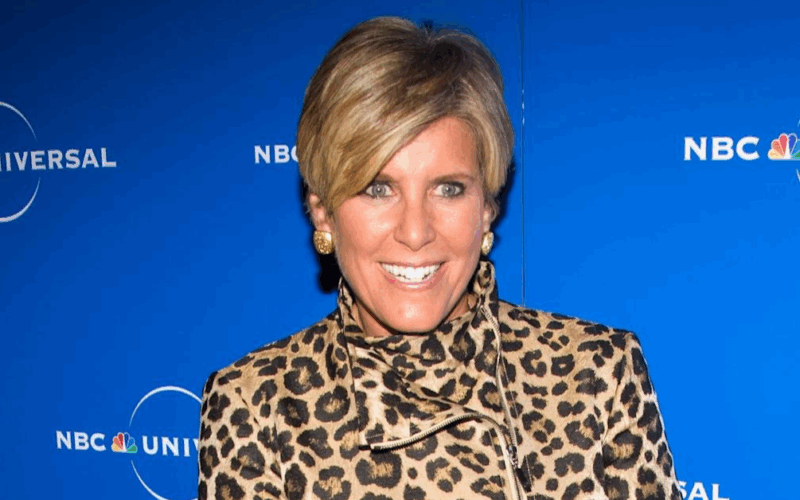

Financial expert Suze Orman has recently shared important insights about the ‘Big Beautiful Bill’ making waves in Washington, especially its impact on Social Security. As the world’s economies face challenges, understanding these updates is crucial for people planning their financial future. This article breaks down the two key points that Suze Orman highlights, helping younger readers grasp the changes and prepare wisely.

Social Security is a vital program for many, providing financial support during retirement, disability, or in case of loss of a family breadwinner. With proposed legislative changes like the ‘Big Beautiful Bill,’ it is essential to stay informed. Suze Orman’s guidance offers clarity on what these changes mean for different generations, especially the younger population who might benefit in the long term.

What Is the ‘Big Beautiful Bill’? A Quick Overview

The ‘Big Beautiful Bill’ refers to a proposed piece of legislation designed to make significant reforms in social safety nets, including Social Security enhancements. Suze Orman explains that this bill aims to strengthen the program, ensuring it remains financially sustainable while providing better benefits to Americans. The bill includes measures to adjust tax policies and increase benefits for low-income workers.

Understanding the bill can be confusing, so it’s helpful to rely on trusted sources. According to the [Social Security Administration](https://www.ssa.gov), the legislation proposes altering how certain benefits are calculated to help stabilize the program’s funds. This is particularly important since Social Security is projected to face funding shortfalls in the coming decades without adjustments.

Two Key Things Suze Orman Wants You to Know

1. Bigger Benefits for Lower-Income Workers

Suze Orman highlights that one of the main benefits of the ‘Big Beautiful Bill’ is the increase in Social Security payments for people with lower lifetime earnings. This change is designed to make retirement safer and more comfortable for millions who otherwise might struggle financially. Orman explains that by tweaking the benefit formula, the bill aims to reduce poverty among seniors.

For younger readers, this means the government recognizes the need to support workers who earn less over their careers. The Congressional Budget Office (CBO) also confirms that the bill’s benefits formula prioritizes lower-income groups, which could motivate more people to trust and plan for Social Security as a significant part of their retirement strategy.

2. Changes in Payroll Taxes to Fund Social Security

Another crucial aspect highlighted by Suze Orman is the form of funding for these improved Social Security benefits. The bill proposes changes to the payroll tax system, specifically by increasing the amount of earnings subject to Social Security taxes. This means higher-income earners would contribute more, helping secure the future of the program.

Orman stresses this step is necessary to keep Social Security afloat without cutting current benefits or raising the retirement age further. The idea is to create a fairer system where those with higher incomes shoulder a bigger part of the cost. This move is supported by economic experts and policy analysts, as noted in a recent [report from the Brookings Institution](https://www.brookings.edu).

What Does This Mean for Younger Generations?

For young people starting their careers or in their early 30s, these changes might feel distant but have long-term implications. Suze Orman advises staying informed and planning early. While the increased taxes might seem like a burden, the promise of stronger benefits in the future could provide much-needed financial security during retirement.

Moreover, understanding how Social Security works and follows legislative changes helps young workers appreciate the importance of paying into the system consistently. As per [Forbes](https://www.forbes.com), early financial planning combined with awareness of Social Security updates can significantly improve retirement outcomes.

How to Stay Updated and Prepare

Keeping up with legislative changes like the ‘Big Beautiful Bill’ is essential. Suze Orman recommends regularly checking credible websites such as the Social Security Administration and financial news platforms. Preparing a personal financial plan that factors in potential changes to Social Security benefits and taxes will help young people feel more secure about their financial future.

In addition, consider consulting financial advisors and using retirement calculators that reflect current policy proposals. This proactive approach ensures you can adapt your savings and investment strategies as the political and economic environment evolves.

Conclusion

Suze Orman’s insights into the ‘Big Beautiful Bill’ highlight two critical points: enhanced benefits for lower-income workers and fairer payroll tax adjustments. These changes aim to secure Social Security’s future and provide better financial support to millions. Staying informed and planning early is the best way for younger people to navigate these updates and ensure a more stable retirement.