Bowling Green, OH – In recent discussions about Social Security’s financial future, a popular suggestion has been to implement a balanced budget amendment as a means to free government funds and secure the system’s longevity. However, this recommendation, as highlighted by Gary R. Lee in a letter to the editor, misses critical details about how Social Security is funded and why such measures may fall short.

Understanding the true mechanics behind Social Security’s funding and the challenges it faces is essential to informed public debate. Experts emphasize that balancing the federal budget alone cannot address the looming Social Security shortfall, which is expected to affect benefit payments after approximately 2033.

The Real Structure of Social Security Funding

Contrary to some beliefs, Social Security does not rely on congressional allocations from the federal budget. Instead, it is funded through three specific revenue streams:

- Payroll taxes paid by workers and employers.

- Interest earned by the trust fund on treasury bonds.

- Income taxes on a portion of benefits received by higher-earning recipients, established since 1983.

As Lee explains, Social Security’s finances are legally independent from the federal government’s general budget, and Congress is prohibited by law from directly allocating or diverting funds to or from the system. He notes,

“This law is the reason why Social Security made it through World War II intact. The finances of the Social Security system are independent of the federal budget.“

This independence means that cutting federal spending elsewhere or implementing a balanced budget amendment would not inherently improve Social Security’s financial health.

Why Is Social Security Running Out of Money?

Experts cite two primary reasons contributing to Social Security’s financial challenges:

- Demographic trends: The 1983 system revision underestimated the decline in birth rates, resulting in fewer workers supporting retirees, particularly the baby boomer generation.

- Income inequality: Increased income disparity has led to a greater share of earnings above the taxable cap, reducing payroll tax revenues.

These factors combine to reduce the inflows to Social Security, creating a funding gap projected to emerge after about 2033.

Effective Solutions to Sustain Social Security

According to financial analysts and policy experts, there are only two viable strategies to ensure Social Security’s ability to pay full benefits after the projected shortfall:

- Reduce benefits: For example, by increasing the eligibility age for full benefits.

- Increase revenues: By raising payroll taxes or lifting the income cap subject to taxation.

Attempts to address Social Security’s challenges through broader federal budget balancing, such as spending cuts, are unlikely to be effective. Lee stresses the impracticality of balancing the federal budget by cutting spending and its irrelevance to Social Security’s core fiscal issues.

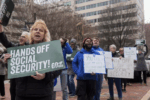

Broader Public Discourse on Related Issues

This letter about Social Security was part of a larger conversation in the community touching on various topics including public health policy, recycling initiatives, mental health and the legal system, geopolitical commentary, and local political actions. These diverse opinions reflect a community deeply engaged in current affairs and policy debates.

Additional Perspectives Highlighted in Recent Letters

- Concerns over anti-vaccine political influence and public health measures.

- A new recycling program in Toledo expanding accepted items, aiming to reduce illegal dumping.

- Discussion about the limitations of the legal system in addressing severe mental illness and crime.

- Historical parallels drawn between current diplomatic approaches and appeasement policies.

- Local officials’ controversial decisions concerning foreign policy and community values.

What Can You Do?

Understanding the complexities of Social Security funding is vital for informed public discussion and policymaking. As debates continue, citizens are encouraged to engage thoughtfully and advocate for sustainable solutions.